a money market account quizlet|More : Tagatay Study with Quizlet and memorize flashcards containing terms like money market, function of money market, players in the money market and more. Ver The Rookie Episódios completos | Disney+. Recomeçar não é fácil para um tipo de uma cidade pequena.

0 · money market vs savings account

1 · money market refers to quizlet

2 · money market mutual funds quizlet

3 · money market flashcards

4 · money market deposit accounts quizlet

5 · money market account flashcard

6 · an online savings account quizlet

7 · a money market is quizlet

8 · More

Resultado da Get Darts betting tips from experienced tipsters, free at bettingexpert. Darts betting previews, value bets and recommended odds here. 18+, T&Cs Apply.

a money market account quizlet*******A money market account is an interest-bearing savings account that offers a higher-yield interest rate, allowing you to earn faster than a traditional savings account. Although it has many similar account features, like an ATM card, a money market account requires a .Study with Quizlet and memorize flashcards containing terms like money market, .Study with Quizlet and memorize flashcards containing terms like money market .

Study with Quizlet and memorize flashcards containing terms like money market, function of money market, players in the money market and more.Study with Quizlet and memorize flashcards containing terms like money market accounts, a high balance requirement overdraft protection a high rate of interest, . Money market account vs. savings account: Money market accounts are a kind of savings account that typically offer debit cards and checks. But some regular . A money market account is a consumer savings product available at most banks and credit unions. Money market accounts combine features of savings accounts and checking accounts—such as the.

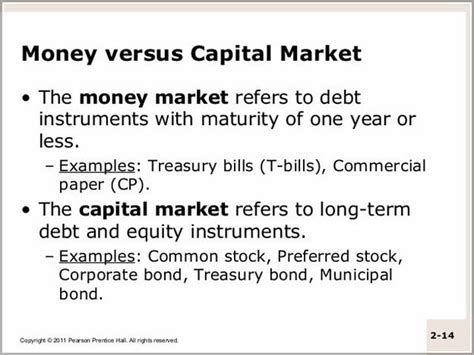

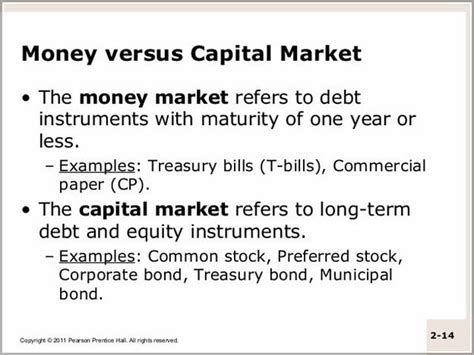

The term money market account (MMA) refers to an interest-bearing account at a bank or credit union. Sometimes referred to as money market deposit accounts (MMDA), money market accounts have.Prepare for your banking exam with Quizlet and learn terms related to money, currency, and deposits. Practice with 20 flashcards and multiple-choice questions. Money market accounts are a type of savings account that can be opened at any bank or credit union. Money market accounts usually offer higher interest rates . The money market refers to trading in very short-term debt investments. At the wholesale level, it involves large-volume trades between institutions and traders. At the retail level, it.

Federal Reserve Board. the guardian of the American financial system. To be used as a medium of exchange, money must be: durable. Study with Quizlet and memorize flashcards containing terms like Money Market Fund differs from a bank money market account because, A check, A debit card and more.Study with Quizlet and memorize flashcards containing terms like Step 1 of 11 Your goal in this lesson is to compare returns from a savings account and a money market account, and then to choose the best money market account based on yield and fees. You have an apartment, a checking account and a pile of cash to invest! Your rent and electric bills .

The function of a financial planner is: To help you define and reach your financial goals. Study with Quizlet and memorize flashcards containing terms like True or False: Savings accounts generally offer a higher yield than money market accounts, FDIC .Cambridge IGCSE and O Level Business Studies. 5th Edition • ISBN: 9781510421233 Karen Borrington, Peter Stimpson. 725 solutions. 1 / 4. Find step-by-step solutions and your answer to the following textbook question: Money market deposit accounts are included in: A. M1 only. B. M2 only. C. neither M1 nor M2. D. both M1 and M2..Cambridge IGCSE Business Studies. Find step-by-step Economics solutions and your answer to the following textbook question: Compared to money market accounts, CDs are _____ liquid and have _____ interest rates? A. less; .Study with Quizlet and memorize flashcards containing terms like Liquidity refers to your ability to cover any long-term deficiencies (true/ false), Money management has no relationship to the personal cash flow statement (true/ false), Overdraft protection for a checking account is a low-cost, short-term loan (true/ false) and more.

A Money Market Deposit Account is similar to regular savings account, but offers a higher rate of interest in exchange for larger than normal deposits. A Money Market Fund invests in low risk securities. Not FDIC insured, but considered safe because they are government securities. Pay higher interest rates that the deposit accounts, but are .31 terms Images. acschaefer_. 1 / 4. Study with Quizlet and memorize flashcards containing terms like money market, demand for money, supply of money and more.

Money Market Deposit Account advantages. safe, earns interest, check writing privileges. money market deposit account disadvantages. high minimum balances/penalties, interest rates below alternatives. Certificates of Deposit advantages. safe, fixed interest rate, convenient. certificates of deposit disadvantages.7th Edition • ISBN: 9781305071759 Lothar Redlin, Stewart, Watson. 9,756 solutions. 1 / 4. Find step-by-step Precalculus solutions and your answer to the following textbook question: A money market account pays 5.2% annual interest, compounded daily. If $100,000 is invested in this account, how long will it take for the account to accumulate .Study with Quizlet and memorize flashcards containing terms like 1) Included in M2 but not in M1 are A) savings accounts and money market mutual funds. B) savings accounts and checkable deposits. C) money market mutual funds and currency. D) currency and checkable deposits., 2) Included in both M1 and M2 are A) savings accounts and .A money market account: Can have a minimum deposit requirement and variable interest, and generally pays a better interest rate than a savings account Are a low-risk investment, have very little growth potential over a long term, and are insured by the federal government

Money market accounts let you grow your money more quickly, but without the uncertainty tied to investment accounts. Eligible money market accounts are FDIC-insured up to $250,000 per depositor .a money market account quizletStudy with Quizlet and memorize flashcards containing terms like checking account, savings account, money market accounts and more.

Study with Quizlet and memorize flashcards containing terms like 1) Included in M2 but not in M1 are A) savings accounts and money market mutual funds. B) savings accounts and checkable deposits. C) money market mutual funds and currency. D) currency and checkable deposits., 2) Included in both M1 and M2 are A) savings accounts and .

A money market account: Can have a minimum deposit requirement and variable interest, and generally pays a better interest rate than a savings account Are a low-risk investment, have very little growth potential over a long term, and are insured by the federal government Money market accounts let you grow your money more quickly, but without the uncertainty tied to investment accounts. Eligible money market accounts are FDIC-insured up to $250,000 per depositor .Study with Quizlet and memorize flashcards containing terms like checking account, savings account, money market accounts and more.what is a money market account. a savings account that has a higher interest rate than a regular savings account. great place to keep your emergency fund. you are in the 25% tax bracket, the before-tax savings rate of return is 12%, the after-tax yield on the savings account is. 9%. online payments do not include. smart cards. use a debit card to.

Study with Quizlet and memorize flashcards containing terms like What characteristics define the money markets?, Is a Treasury bond issued 29 years ago with six months remaining before it matures a money market instrument?, Why do banks not eliminate the need for money markets? and more.if you are putting aside a chunk of money to purchase a house in five years. Karina keeps excellent records and always knows precisely how much is in her bank account. However, when she receives her bank statement, she's surprised to see that she has been charged a $5.00 overdraft fee. After reviewing her well-kept records, she cannot find .

Balance in your checkbook, $356. Balance on bank statement, $472. Service charge and other fees, $15. Interest earned on the account, $4. Total of outstanding checks, $187. Deposits in transit, $60. Bank balance $472 - outstanding checks $187 + deposit in transit $60 = $345. Checkbook balance $356 + interest earned $4 - service charge/fees $15 .3rd Edition • ISBN: 9781464122163 Daren S. Starnes, Josh Tabor. 2,555 solutions. 1 / 4. Find step-by-step Statistics solutions and your answer to the following textbook question: A bank offers a money market account paying 4.9% interest compounded semiannually. A competing bank offers a money market account paying 4.8% interest compounded daily.a money market account quizlet Morea. $10,000 b. $6,000 c. $4,000 d. $0. c. $4,000. Generally, an adjusting journal entry . a. is used in both accrual basis and cash basis accounting. b. affects both the income statement and the balance sheet. c. affects only the income statement. d. .

Study with Quizlet and memorize flashcards containing terms like Introduction of MMMF, MMMF exempt from (1970), MMMF can hold and more. . (Chapter 5) Money market accounts vs. Money market funds. 5 terms. Kevin_Catete. Preview. accounting chapter 10. 13 terms. juliaviehwegg. Preview. Banks and Other Financial Institutions Chpt. 3 .

Rate the following bank accounts from most to least liquid: CD, savings account, checking account, money market account. Study with Quizlet and memorize flashcards containing terms like Katherine invests $7,770 in a six-month money market account giving 5.8% simple annual interest and $12,500 in a three-year CD giving .

More Rate the following bank accounts from most to least liquid: CD, savings account, checking account, money market account. Study with Quizlet and memorize flashcards containing terms like Katherine invests $7,770 in a six-month money market account giving 5.8% simple annual interest and $12,500 in a three-year CD giving .

WEB*** Bolo Fake 3 Andares No Tema Stumble Guys Pronta Entrega ***Bolo Fake Stumble Guys Medidas das Bases:1 - 30cm largura2 - 25cm Largura3 - 20cm LarguraObserve:Altura do bolo é de 30cmENVIO IMEDIATO!!!!!!!!!!Quem Somos? Somos uma empresa familiar que acredita em sonhos!A CD TOYS tem como missão dar um .

a money market account quizlet|More